Free Personal Budget Template. For Individuals & Families

Free personal budget template for household finances. Track salary, side hustles, family expenses, and savings goals. Perfect for couples and families. Works in Google Sheets and Excel, start free.

Drag and drop

or browse for expense files

How it Works

1. Upload your expense file

Upload a CSV or XLSX file with your expenses. That's all you need to get started. Our system supports various formats and automatically detects the structure of your data.

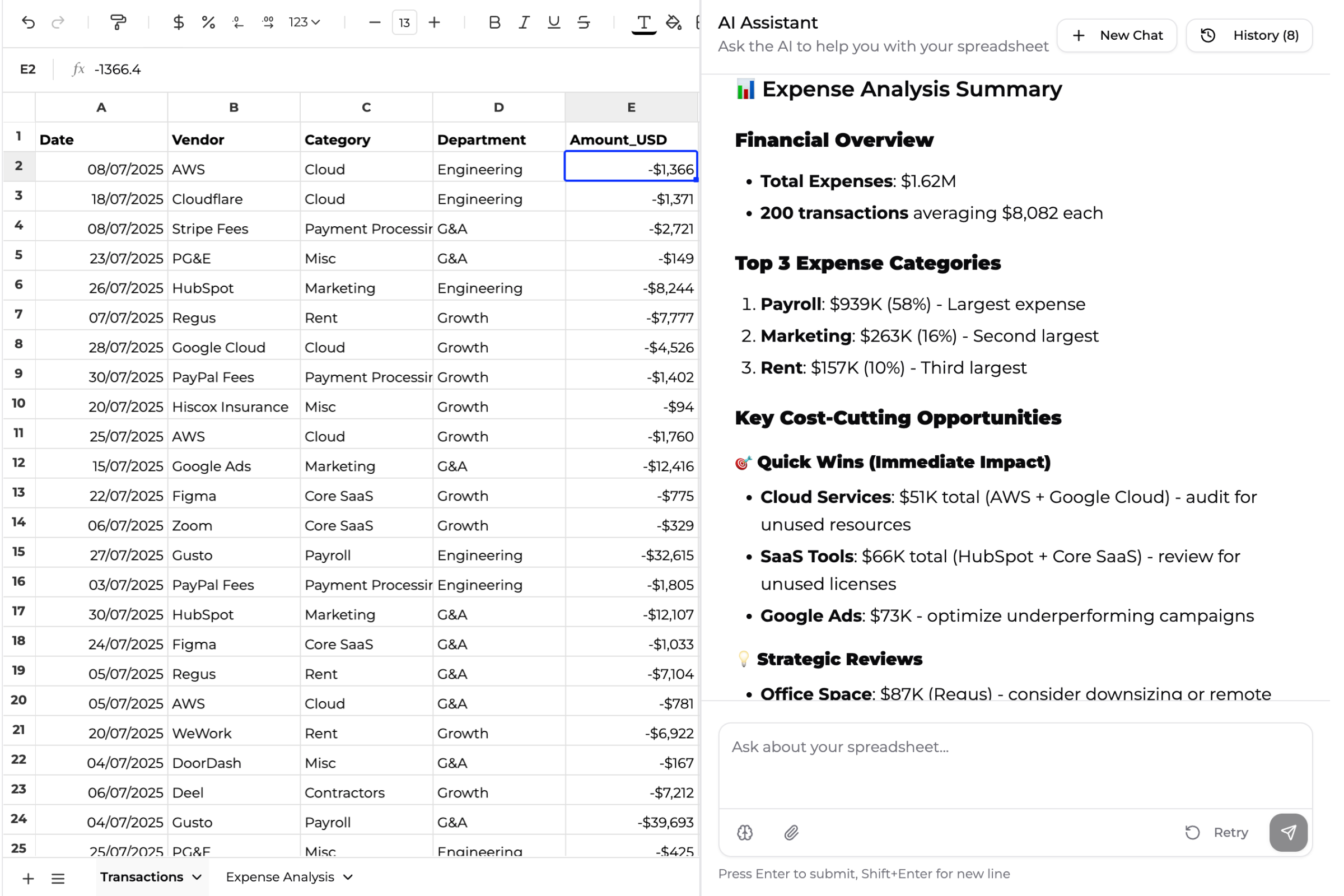

2. Superworker gets to work

Superworker cleans and organizes your data, then runs the analysis in a spreadsheet. Our AI automatically categorizes expenses, identifies duplicates, and structures your data for optimal insights.

3. Get your spreadsheet with insights

You'll receive a spreadsheet with organized data and actionable insights. From there, you can ask follow-up questions, dive deeper into the numbers, or export your data for further analysis.

What our users say

"Superworker saved me so much time when I was building a competitive analysis. I finished a full review in just a few hours, something that used to take weeks."

"Superworker helped me analyze my Google Cloud billing data, it showed me where I was overspending, and I ended up cutting my costs by 50%."

"I absolutely love what you’ve built! It’s saving me hours and hours of time. Superworker makes spreadsheets feel easy and magical, even for non-technical people like me."

Your personal finances aren't a business—don't budget like one

Most budget templates treat you like a corporation. Line items. Quarterly projections. Departmental allocations.

You're not managing accounts receivable. You're figuring out if you can afford that vacation, whether to max out your 401k, or how to split rent with your partner.

Personal budgets need personal categories: date nights, dog expenses, holiday gifts, emergency fund contributions. This template gets it.

AI builds your personal budget from your real life

Upload your bank statement or expense history. Superworker's AI creates a personal budget:

• Tracks personal income (salary, side hustle, freelance work)

• Recognizes household expenses (groceries, utilities, rent/mortgage)

• Identifies personal spending (clothes, coffee, hobbies)

• Sets up savings goals (emergency fund, vacation, down payment)

• Categorizes family costs (kids, pets, childcare)

No business jargon. Just categories that match how you actually live and spend.

Built for individuals, couples, and families

Single? Track your income, spending, and savings goals. Build an emergency fund. See where your money goes each month.

Couples? Share the budget in Google Sheets. Split shared expenses (rent, groceries) vs personal spending (clothes, hobbies). Decide on joint savings goals.

Families? Budget for kids' expenses, activities, and childcare. Track household bills. Plan for bigger costs like back-to-school shopping or family vacations.

One template adapts to your situation—no complicated setup required.

Personal income tracking (salary, side hustles, gig work)

Track all your personal income sources:

Salary/wages: Your main job (after-tax take-home pay)

Side hustles: Freelance, consulting, part-time work

Gig economy: Uber, DoorDash, TaskRabbit, Fiverr

Passive income: Dividends, interest, rental income

Other income: Tax refunds, gifts, bonuses

See total monthly income across all sources. Perfect for people with multiple income streams or variable pay.

Household expense categories that make sense

Personal budgets need personal categories. Our template includes:

Housing: Rent/mortgage, utilities, internet, home maintenance

Food: Groceries, dining out, coffee shops, meal delivery

Transportation: Car payment, insurance, gas, public transit

Personal Care: Haircuts, gym, clothing, toiletries

Family: Childcare, kids' activities, pet expenses, school costs

Entertainment: Streaming services, hobbies, date nights, events

Savings: Emergency fund, vacation fund, retirement contributions

Add or remove categories to fit your life. The budget adapts to you.

Personal vs business budget: What's the difference?

Wondering if you need a personal or business budget? Here's the difference:

Personal Budget: For your household finances—salary, groceries, rent, savings goals, family expenses. Tracks personal spending and income.

Business Budget: For your company—revenue, expenses, payroll, profit margins, business investments. Tracks business operations and growth.

Use this template if you're budgeting for yourself, your family, or your household. Use a business budget if you're managing company finances, even if you're self-employed (keep personal and business separate!).

Frequently Asked Questions

A personal budget tracks your household finances—income from your job, family expenses, personal spending, and savings goals. A business budget tracks company operations—revenue, business expenses, payroll, and profit. Even if you're self-employed, keep them separate: personal budget for your salary and household, business budget for company finances.

Yes! Download as CSV or Excel to use in Google Sheets and share with your partner. Both of you can update expenses in real-time, see monthly totals, and track progress toward shared goals. Perfect for managing household finances together.

Absolutely. The template includes family-specific categories like childcare, kids' activities, school expenses, and pet costs. Track income and expenses for your entire household, set family savings goals, and see where your money goes each month.

Yes. Add multiple income sources—salary, freelance work, gig economy, passive income. The template shows total monthly income and breaks it down by source. Great for anyone with multiple income streams.

Yes, but with a caveat. Use this template for your personal/household finances (your salary you pay yourself, family expenses, personal spending). Keep a separate business budget for your company operations (revenue, business expenses, profit). Never mix personal and business finances!

Absolutely. Add savings categories for emergency fund, vacation fund, down payment, or any other goal. The template tracks how much you've saved and how much you need to reach your target.

Works great for both! If you're single, track your personal income and spending. If you're a couple or family, add shared expenses and multiple income sources. The template adapts to your situation.

Yes. Create categories for shared expenses (rent, groceries, utilities) and personal spending (your hobbies, their clothes shopping). Perfect for couples who split some costs but keep other spending separate.

The template includes housing, food, transportation, personal care, family/kids, pets, entertainment, subscriptions, healthcare, debt payments, and savings. You can add, remove, or rename any category to match your lifestyle.