Free Budget Spreadsheet. Real-Time Tracking

Active budget spreadsheet that tracks your spending in real-time. Not just a blank template working file with AI insights. Upload transactions, monitor budgets, and see patterns automatically.

Drag and drop

or browse for expense files

How it Works

1. Upload your expense file

Upload a CSV or XLSX file with your expenses. That's all you need to get started. Our system supports various formats and automatically detects the structure of your data.

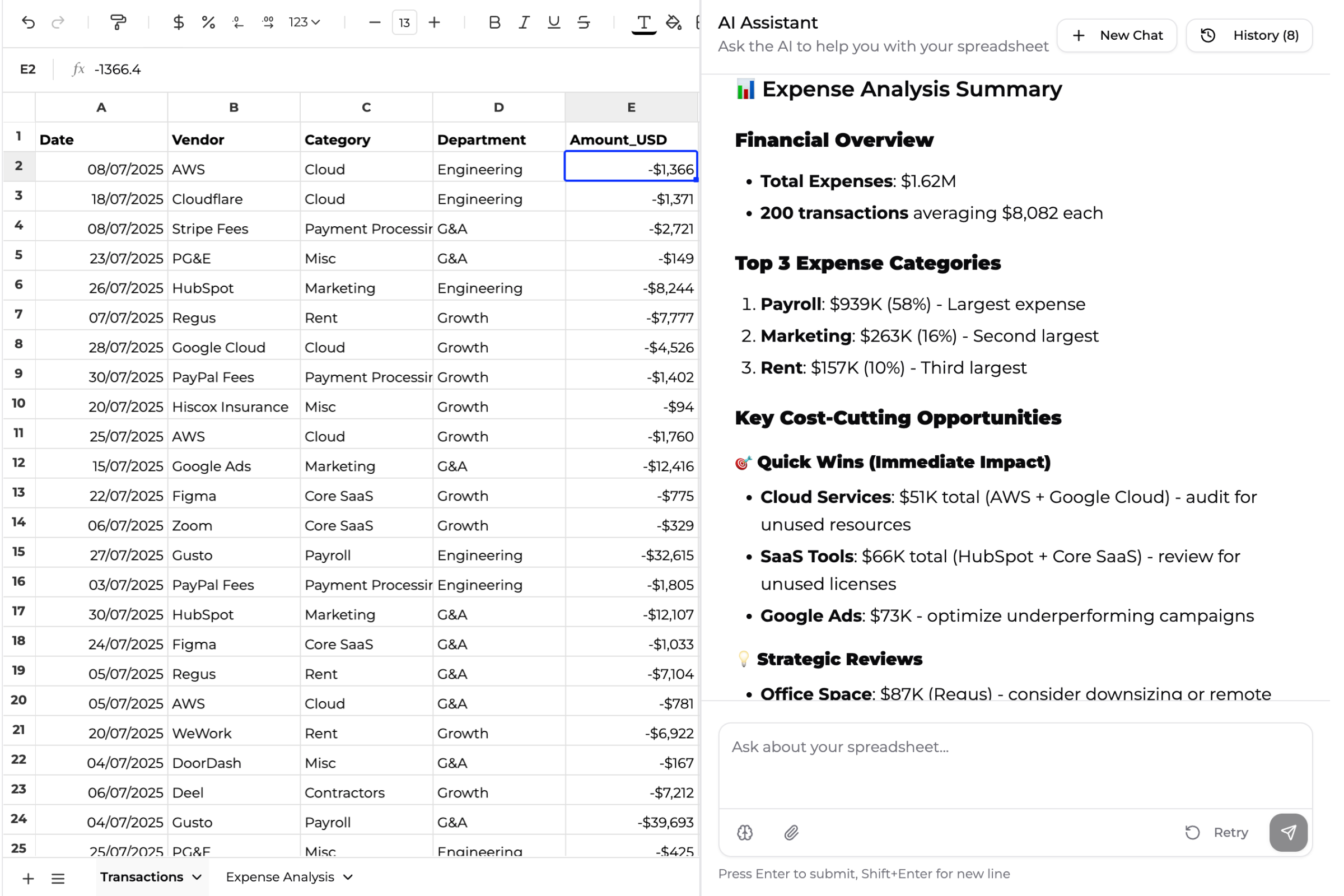

2. Superworker gets to work

Superworker cleans and organizes your data, then runs the analysis in a spreadsheet. Our AI automatically categorizes expenses, identifies duplicates, and structures your data for optimal insights.

3. Get your spreadsheet with insights

You'll receive a spreadsheet with organized data and actionable insights. From there, you can ask follow-up questions, dive deeper into the numbers, or export your data for further analysis.

What our users say

"Superworker saved me so much time when I was building a competitive analysis. I finished a full review in just a few hours, something that used to take weeks."

"Superworker helped me analyze my Google Cloud billing data, it showed me where I was overspending, and I ended up cutting my costs by 50%."

"I absolutely love what you’ve built! It’s saving me hours and hours of time. Superworker makes spreadsheets feel easy and magical, even for non-technical people like me."

A Working Budget Spreadsheet, Not Just a Blank Template

Most budget templates are blank spreadsheets waiting for you to fill them in. A budget spreadsheet is different. It's a working file that grows with your spending history:

Template vs Spreadsheet:

• Template A starting framework with blank categories and formulas

• Spreadsheet A working document populated with your actual transaction data

• Template You start fresh each month

• Spreadsheet Your data accumulates over time for historical analysis

Think of a template as the blueprint. Your budget spreadsheet is the house you're building and actually living in.

Active Tracking, Not Static Planning

Your budget spreadsheet updates continuously with real spending data:

• Real transactions Upload bank exports and see actual spending, not estimates

• Historical tracking Keep 6, 12, or 24 months of data in one spreadsheet

• Pattern recognition AI spots spending trends over time

• Cumulative insights The more data you add, the smarter it gets

• Working file One spreadsheet you update continuously, not monthly templates

Your budget spreadsheet becomes your financial command center. Add new transactions weekly, ask questions anytime, and watch your spending patterns emerge over months.

Budget Spreadsheet Features

Continuous Tracking

Upload bank statements as often as you like. Append new data to existing spreadsheet. Historical data stays intact. Compare any time period. Never lose past transaction details.

AI-Powered Analysis

Ask questions about spending patterns ('Why do I always overspend in December?'). Get alerts when approaching budget limits. Identify recurring expenses automatically. Spot unusual transactions. Predict future spending based on history.

Works with Your Workflow

Download as CSV or Excel to use in Google Sheets or Excel anytime. Keep using your familiar spreadsheet tools. Add manual entries between uploads. Customize categories as your life changes. Works on desktop and mobile.

Perfect for anyone who wants continuous budget tracking rather than starting over each month with a blank template.

Monthly Budget Spreadsheet Tracking

Track your budget month by month in one continuous spreadsheet:

• Monthly views See current month spending vs budget

• Month-over-month comparison Compare this month to previous months

• Seasonal patterns Spot months when you naturally spend more

• Rolling averages See 3-month or 6-month spending trends

• Budget adjustments Update future month budgets based on past performance

Your budget spreadsheet becomes more valuable over time. After 3 months, you see patterns. After 6 months, you understand your spending rhythms. After a year, you have a complete financial picture.

Frequently Asked Questions

Upload your bank statement or expense CSV. The AI reads your transactions and creates a budget spreadsheet with your actual spending data. Add more transactions anytime to keep your spreadsheet up to date.

A template is a blank starting point. Categories and formulas ready to fill in. A budget spreadsheet is a working file populated with your actual transaction data that you update continuously. Templates are for starting fresh; spreadsheets are for ongoing tracking.

Yes! That's the whole point. Your budget spreadsheet accumulates data over time. Keep 6 months, a year, or even multiple years in one file. The AI uses your history to spot patterns and make better recommendations.

Nope. One budget spreadsheet can track unlimited months. Just upload new transactions and they're added to your existing data. You can view monthly breakdowns, year-over-year comparisons, or any time period you want.

You can create a new budget spreadsheet anytime. But most people find that keeping historical data is valuable. You can always filter to see just recent months if you want a fresh start view.

Absolutely. Download as CSV or Excel anytime with all your data intact. You own your spreadsheet. Use it anywhere, download it, share it, or delete it.

They're very similar! Both track spending continuously. 'Budget spreadsheet' emphasizes that it's a working file you update (not a blank template), while 'budget tracker' emphasizes the tracking functionality. Same great features, just different ways to describe it.

Yes. Create separate budget spreadsheets for personal and business expenses. Or keep them in one spreadsheet with different categories. The AI can separate them for tax reporting or reimbursement.

Yes. Everything is encrypted. We never see your bank credentials. You control what data you upload. Export or delete your budget spreadsheet anytime. Full privacy policy here.