Free Monthly Budget Template. Track Your Spending Month by Month

Free monthly budget template with AI powered month over month analysis. Track spending patterns, compare months, and adjust for seasonal changes. Works in Google Sheets and Excel. Start free no credit card needed.

Drag and drop

or browse for expense files

How it Works

1. Upload your expense file

Upload a CSV or XLSX file with your expenses. That's all you need to get started. Our system supports various formats and automatically detects the structure of your data.

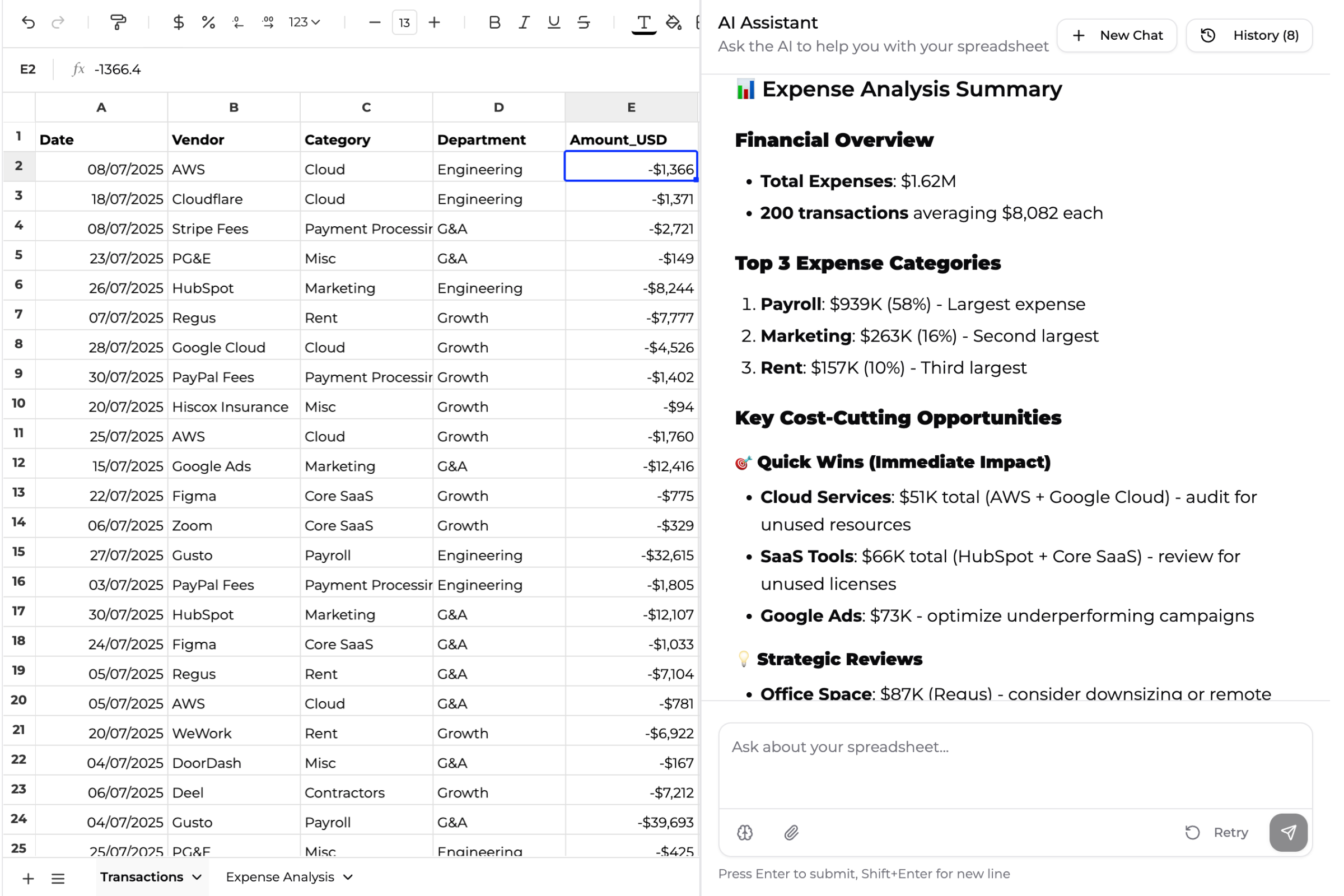

2. Superworker gets to work

Superworker cleans and organizes your data, then runs the analysis in a spreadsheet. Our AI automatically categorizes expenses, identifies duplicates, and structures your data for optimal insights.

3. Get your spreadsheet with insights

You'll receive a spreadsheet with organized data and actionable insights. From there, you can ask follow-up questions, dive deeper into the numbers, or export your data for further analysis.

What our users say

"Superworker saved me so much time when I was building a competitive analysis. I finished a full review in just a few hours, something that used to take weeks."

"Superworker helped me analyze my Google Cloud billing data, it showed me where I was overspending, and I ended up cutting my costs by 50%."

"I absolutely love what you’ve built! It’s saving me hours and hours of time. Superworker makes spreadsheets feel easy and magical, even for non-technical people like me."

Your spending changes every month. Your budget should too.

January: $800 on groceries. February: $600. March: Back up to $750. You're not bad at budgeting—your life just has monthly rhythms.

Holidays. Birthdays. Summer vacations. Back-to-school shopping. Some months are expensive. Some aren't. A one-size-fits-all budget pretends every month is the same. It isn't.

AI builds a budget that adapts month by month

Upload your transaction history. Superworker's AI analyzes monthly patterns:

• Identifies which months you spend more (and why)

• Creates monthly spending targets based on actual history

• Compares this month vs last month automatically

• Flags unusual spikes ('Your dining budget is 40% higher than last March')

• Suggests seasonal adjustments ('You typically spend 15% more in December')

Your monthly budget template reflects reality—not some financial guru's generic advice.

Month-over-month tracking built in

See trends instantly: Compare this month's spending to last month, same month last year, or your 3-month average.

Track recurring monthly expenses: Rent, subscriptions, utilities—see what hits every month vs one-time costs.

Set monthly spending limits: Cap categories by month. Get alerts when you're 80% through your dining budget by the 20th.

Every month gets its own tab in your spreadsheet. Flip between months to see patterns. Watch your progress over time.

Seasonal budgets that make sense

Most budget templates ignore seasons. Ours don't.

December is always expensive (gifts, travel, parties). August hits families hard (back to school). Summer means higher utility bills if you run AC. Winter? Heating costs spike.

Upload 6-12 months of history. The AI spots seasonal patterns and adjusts your monthly budget recommendations. No more 'Why did I blow my budget?' guilt—you knew December would be tight.

Your monthly budget in Google Sheets or Excel

Export your monthly budget as a Google Sheets template or Excel file:

• Monthly tabs - Each month gets its own sheet with categories and totals

• Automatic formulas - Compare months, calculate averages, track trends

• Monthly summaries - See income vs expenses per month at a glance

• Year-over-year views - Compare January 2024 vs January 2025

• Budget vs actual - Planned spending vs what actually happened

Access from any device. Share with your partner. Update on the go. Your monthly budget stays in sync across Google Sheets mobile, desktop, or Excel.

Free to start, simple to use

Get 5 free messages to upload your expenses, generate your monthly budget template, and ask questions like 'Why do I always overspend in October?' No credit card required.

After that, $40/month for unlimited budgets and AI insights. Or $200/month for Business plan with premium models and founder support.

Your financial data stays private—encrypted, owned by you, never sold. Privacy policy here.

Frequently Asked Questions

Regular budgets assume every month is identical. This template analyzes your spending month by month, spots seasonal patterns, and creates realistic monthly targets. If you spend more in December (you do), it factors that in.

No problem. Upload whatever you have—even 2-3 months works. The AI will build your monthly budget and refine it as you add more data. The more months you track, the better it gets at predicting patterns.

Absolutely. That's the whole point. Set higher spending caps for December (holidays), August (back to school), or whenever your expenses typically spike. Each month can have its own budget.

Yes! Upload income data or manually add monthly income. See income vs expenses per month. Track months where you're cash-flow positive vs negative. Perfect for freelancers with variable monthly income.

You'll see percentage changes in spending by category. Example: 'Dining up 23% vs last month' or 'Transportation down 15% vs February.' Helps you spot trends before they become problems.

Yes. Download and upload to Google Sheets, then share the link. Both of you can update spending, add transactions, and see monthly totals in real-time. Perfect for couples managing household budgets together.

You get monthly tabs for each period, automatic month-over-month comparisons, monthly spending limit alerts, category breakdowns by month, seasonal pattern detection, and historical trend charts. Everything updates automatically as you add expenses.

Absolutely. Variable income is perfect for monthly budgeting. Track what you earn each month, see which months are strong vs weak, and adjust spending accordingly. The AI helps you build reserves in high-income months for leaner periods.

Yes. Just ask the AI: 'How much did I spend on groceries in March?' or 'Show me dining expenses for the last 3 months.' You'll get instant answers with breakdowns and comparisons.