Free Expense Report Template. For Business Reimbursement

Free business expense report template for employee reimbursement. AI powered categorization for travel, meals, and supplies. Professional format for corporate submission. Works in Google Sheets and Excel, start free.

Drag and drop

or browse for expense files

How it Works

1. Upload your expense file

Upload a CSV or XLSX file with your expenses. That's all you need to get started. Our system supports various formats and automatically detects the structure of your data.

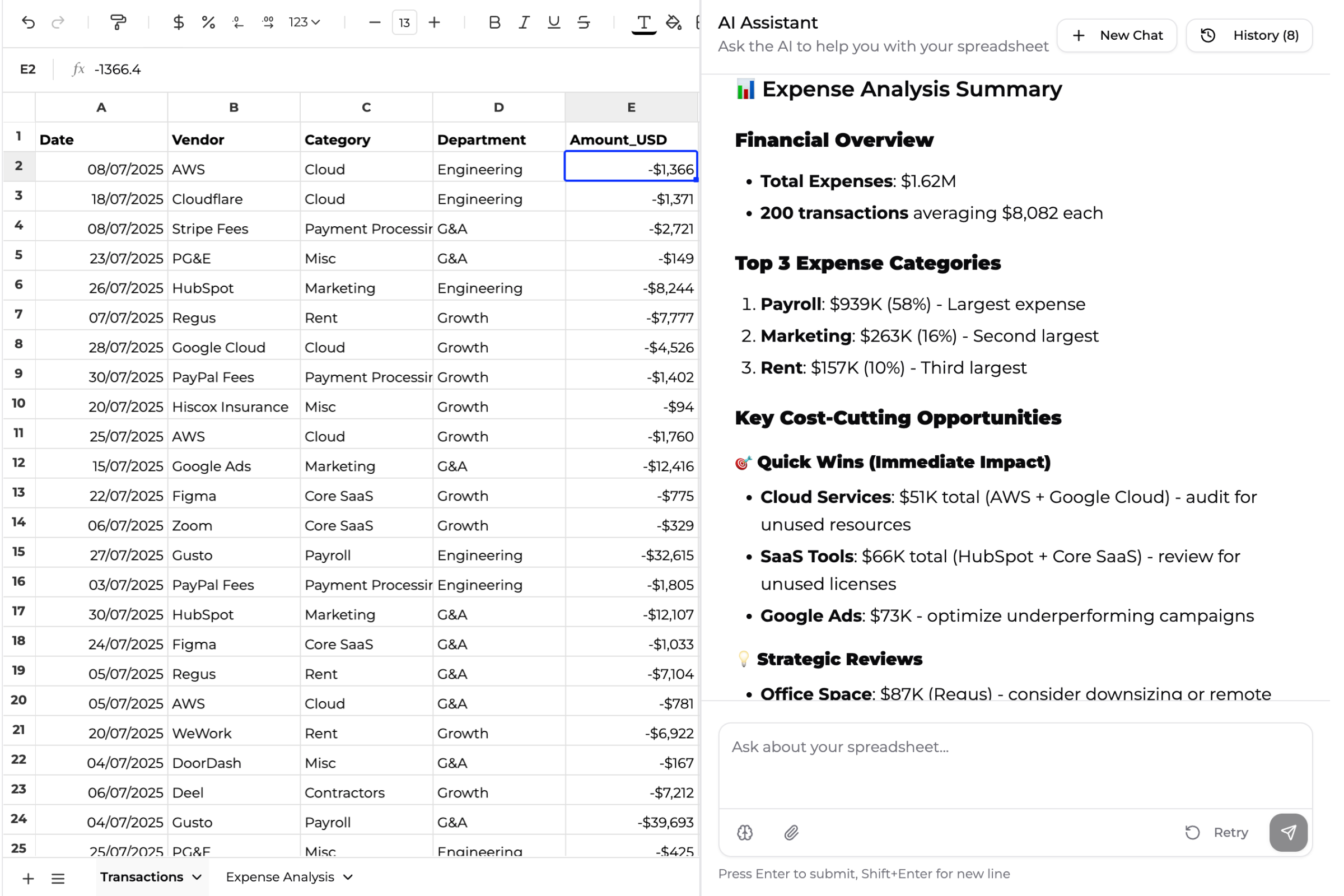

2. Superworker gets to work

Superworker cleans and organizes your data, then runs the analysis in a spreadsheet. Our AI automatically categorizes expenses, identifies duplicates, and structures your data for optimal insights.

3. Get your spreadsheet with insights

You'll receive a spreadsheet with organized data and actionable insights. From there, you can ask follow-up questions, dive deeper into the numbers, or export your data for further analysis.

What our users say

"Superworker saved me so much time when I was building a competitive analysis. I finished a full review in just a few hours, something that used to take weeks."

"Superworker helped me analyze my Google Cloud billing data, it showed me where I was overspending, and I ended up cutting my costs by 50%."

"I absolutely love what you’ve built! It’s saving me hours and hours of time. Superworker makes spreadsheets feel easy and magical, even for non-technical people like me."

Expense reports shouldn't take longer than the actual trip

You just got back from a business trip. Now comes the fun part: digging through crumpled receipts, remembering which meal was client entertainment, and filling out that expense report your finance team requires.

Two hours later, you're still categorizing Uber rides and wondering if that airport coffee counts as 'meals' or 'travel.' There's got to be a better way.

AI builds your expense report from receipts and transactions

Upload your receipts, credit card statement, or expense list. Superworker's AI instantly:

• Categorizes expenses by type (travel, meals, lodging, supplies)

• Identifies business vs personal charges

• Formats everything for corporate submission

• Calculates totals by category

• Creates a professional expense report ready for approval

No manual entry. No category guessing. Just upload and submit.

Built for employee reimbursement

Business travel? Track flights, hotels, rental cars, ground transportation. Separate personal charges automatically.

Client meals? Identify dining expenses, tag who attended, note business purpose. All required for reimbursement.

Office supplies? Categorize equipment, software, office materials, and other business purchases.

The template follows standard corporate expense report formats. Your finance team will actually thank you.

Professional format for manager approval

Corporate expense reports need specific information:

Date and description: When and what you purchased

Category: Travel, meals, supplies, lodging, etc.

Amount: How much you're claiming

Business purpose: Why this expense was necessary

Receipt documentation: Proof of purchase

Approval workflow: Manager sign-off section

Our template includes all required fields. Download as CSV or Excel to use in Google Sheets or Excel, attach receipts, and submit for reimbursement.

Expense report vs expense tracker: What's the difference?

People often confuse expense reports with expense trackers. Here's the distinction:

Expense Report: A one-time document submitted for business reimbursement. Created after a trip, project, or purchase. Submitted to your employer for payback. Includes receipts and approval signatures.

Expense Tracker: Ongoing monitoring of all your spending over time. Used for personal budgeting or business accounting. Tracks patterns, not individual reimbursements.

Use this template if you need to get reimbursed by your employer. Use an expense tracker if you're monitoring ongoing spending for budgeting purposes.

Business expense categories included

Standard business expense categories for corporate reimbursement:

Travel: Flights, trains, rental cars, parking, tolls, mileage

Lodging: Hotels, Airbnb, extended stays

Meals & Entertainment: Client dinners, business lunches, conference meals

Supplies: Office materials, equipment, software, tools

Professional Development: Training, conferences, certifications, books

Communication: Phone, internet, shipping, postage

Other: Miscellaneous business expenses

All categories follow standard corporate accounting practices. Your finance team will recognize them immediately.

Frequently Asked Questions

An expense report is a one-time document submitted to your employer for reimbursement—like after a business trip. It includes specific expenses, receipts, and approval signatures. An expense tracker monitors ongoing spending over time for budgeting or accounting. Use this template for getting reimbursed; use an expense tracker for continuous spending monitoring.

Yes! That's exactly what it's designed for. The template follows standard corporate expense report formats, includes all required fields (date, amount, category, business purpose), and creates a professional report ready for manager approval and finance processing.

Absolutely. Upload your travel expenses (flights, hotels, meals, ground transportation). The AI categorizes everything, separates personal vs business charges, and creates a travel expense report formatted for corporate submission. Perfect for business trips and conferences.

The template includes standard corporate categories: Travel (flights, rental cars, mileage), Lodging (hotels), Meals & Entertainment (client dinners, business lunches), Supplies (office materials, equipment), Professional Development (training, conferences), Communication (phone, shipping), and Other. All follow standard accounting practices.

Yes. The expense report template includes sections for employee information, expense details, totals by category, business purpose, receipt documentation, and manager approval signatures. Everything your finance team needs to process reimbursement.

The template creates the expense report spreadsheet. You'll need to attach receipt scans or photos separately when submitting to your employer—most companies require this for reimbursement. The report includes a column to note which receipts are attached.

This template is specifically for business expense reimbursement—submitting expenses to your employer for payback. If you want to track ongoing personal or business expenses for budgeting, use our Expense Analyzer template instead.

The template creates a standard Excel or Google Sheets expense report that you can submit through your company's process. Many companies accept spreadsheet expense reports; some require uploading to their accounting system. Check your company policy. The data can be easily copied into most corporate expense tools.

This template is designed for employee reimbursement (submitting expenses to an employer). If you're a contractor or freelancer tracking business expenses for tax deduction, you might want a business expense tracker instead. However, if a client requires expense reports from contractors, this format works great.